- VeradiVerdict

- Posts

- Cross-Chain Liquidity

Cross-Chain Liquidity

VeradiVerdict - Issue #142

The ubiquitous automated market maker (AMM) model of DeFi (used in Uniswap, Balancer, and more) is largely credited for the explosion of “liquidity” on blockchains like Ethereum today, but still results in a significant concentration of assets across a small number of blockchains/dapps and prevents users like liquidity providers (LPs) from leveraging the full potential of their capital.

Unbound Finance is a new decentralized cross-chain liquidity protocol, building an ecosystem of composable, DeFi-native derivatives from AMMs on Ethereum and other blockchains. Unbound will offer a suite of products to unlock liquidity from a diversity of AMMs on different blockchains, including synthetic assets collateralized by liquidity provider tokens (LPTs), new liquidity pools cross-derived from multiple AMMs, financial instruments to compound yields and returns, and more.

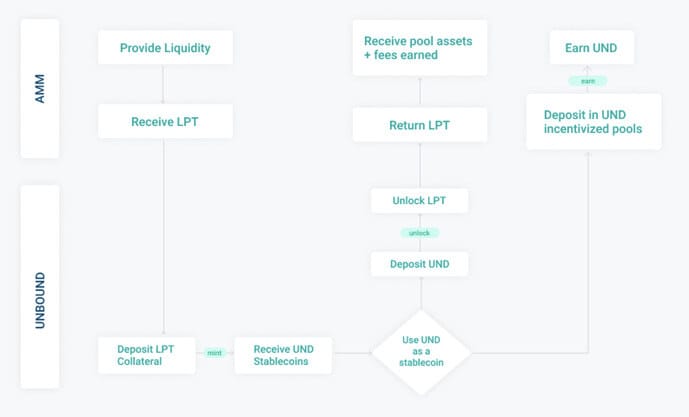

The protocol’s first flagship product is the UND stablecoin (pegged to the USD, collateralized by LPTs), which enables LPs to access some of the liquidity they have already locked into liquidity pools on AMMs like Uniswap. LPs can deposit LPTs (which they receive from AMMs in exchange for supplying liquidity) to the protocol and can take out loans in UND in exchange. They can redeem their LPTs from the protocol at any time by returning the exact amount of UND they minted back to the protocol, meaning that users can essentially take out interest-free loans with their LPTs as collateral, and are never at risk of having their collateral liquidated, since Unbound does not maintain a liquidation engine.

Unbound is able to offer these incredible loans by predicting the critical amount of impermanent loss that LPTs must undergo in order for loans to become undercollateralized. These predictions are a proxy for the risk of undercollateralization, which is then used to set the loan-to-value ratio (LTV) of loans on Unbound (the maximum amount of UND a user can mint in exchange for some value of collateral). Unbound maintains the peg of the UND to the US dollar via variable fees charged for minting UND and its own AMMs (currently a UND-DAI pair). The protocol already integrates with 12 AMMs on Ethereum, including Uniswap, Balancer, and Curve Finance.

Unbound has already launched testnet on BSC to include AMMs like PancakeSwap. Soon to follow will be integrations with Polygon, Harmony and other EVM based public blockchains, helping realize the vision of cross-chain derivatives in DeFi. The protocol will also launch more products including other synthetic assets (like uETH, a token that tracks the price of ETH), virtual AMMs that automatically supply liquidity, and a liquidation engine for extremely volatile, high-risk pairs.

Ultimately, Unbound Finance offers one of the first ways for DeFi users like LPs to use assets that they have already locked up into popular DeFi protocols like Uniswap, enhancing open flow of liquidity across Ethereum and other blockchains, laying the path for the highly-composable, cross-chain DeFi of the future.

The Illiquid Side of DeFi Liquidity Pools

In 2018, Uniswap drastically changed the trajectory of the entire decentralized finance (DeFi) universe with the launch of its automated market maker (AMM) –– a new way for crypto holders and traders to instantaneously access liquidity for a myriad of assets on Ethereum, without having to interface with order books and inefficient, inaccessible centralized exchanges. Uniswap proposed that crypto hodlers could supply their holdings to “liquidity pools” (essentially a portfolio of two assets that maintains a constant ratio between the total value of each asset), which could then be used programmatically to execute trades or “swaps” between two assets, making it easier than ever for crypto traders to instantaneously exchange one kind of asset for another. Since its launch, the AMM model has become ubiquitous within DeFi, inspiring other popular protocols like Curve and Balancer.

The AMM model is largely responsible for the explosion of “liquidity” on Ethereum, which essentially refers to how easy it is for a crypto trader to exchange one kind of asset for another at the existing market price. Still, this current conception of “liquidity” in DeFi is extremely limited, since the AMM model requires liquidity providers (LP) to lock up their assets in the protocol, meaning that these assets can’t be used by the LP practically anywhere else. Additionally, the viral popularity of the AMM model has led to a significant concentration of “liquidity” and assets on Ethereum (as opposed to across multiple alternative blockchains) and a countable number of Ethereum-based dapps, making DeFi much more centralized than it was ever intended to be. To truly realize the vision of “decentralized finance,” where users can easily exchange any asset on any blockchain without relying on a few popular, trusted parties, it’s critical that the crypto community comes up with new and exciting ways to unlock the liquidity concentrated into these DeFi protocols, through derivatives and synthetic assets like stablecoins, pegged tokens, and more.

What is Unbound Finance?

Unbound Finance is a new decentralized cross-chain liquidity protocol, building an ecosystem of composable, DeFi-native derivatives from AMMs on Ethereum and other blockchains. At a high-level, Unbound generates new synthetic assets using liquidity provider tokens (LPTs, which are given to liquidity providers in exchange for supplying liquidity to a protocol like Uniswap) as collateral. These LPTs are generally not tradable but still represent a significant amount of value, meaning that without a derivative component, their value cannot be realized until they are redeemed for a share of the liquidity pool that they represent.

Unbound plans to offer a suite of products that unlock liquidity from existing AMMs, including:

Synthetic assets (stablecoins, pegged tokens that track the value of other assets like ETH or BTC, etc.)

liquidity pools cross-derived from multiple different AMMs (e.g. composing new AMMs from multiple existing ones)

oracle price feeds

financial instruments to compounding yields and margin trades.

Unbound’s final testnet launched on Ethereum in April of this year, and the first product that the protocol offers is a new kind of stablecoin, called UND, which is pegged to the US dollar, is fully decentralized, and is completely collateralized by LPTs, instead of more volatile, traditional assets like BTC and ETH.

How does the UND Stablecoin Work?

When a user supplies liquidity to a Uniswap liquidity pool, they receive an LPT in exchange that essentially represents their “share” of the value locked in that liquidity pool. For instance, if Alice supplied 1 ETH and 100 USDC (in a universe where the market price of 1 ETH was 100 USDC) to a Uniswap liquidity pool with 9 ETH and 900 USDC, she would receive an LPT that essentially denotes that she owns 10% of the total value locked in that particular liquidity pool at any given time. LPTs are generally considered to be much more stable than traditional crypto-assets like BTC and ETH, since the value of assets in a liquidity pool are aggressively maintained by arbitrageurs that correct asset prices in the liquidity pool to match market asset prices when they fluctuate.

In Unbound’s protocol, Alice can deposit her LPT as collateral to receive the UND stablecoin in exchange, equivalent to a proportion (we’ll get to this later) of the current value of the LPT in USD, minus a small minting fee. Alice can then immediately use her UND in a variety of other DeFi products (other market makers, lending protocols, etc.), meaning that she can simultaneously use her capital to earn returns as a liquidity provider (by locking up assets into a liquidity) pool and to participate with the DeFi ecosystem (using the UND she’s received from Unbound). To get back her LPT, Alice simply needs to supply the same amount of UND that she initially received back to the Unbound protocol, which will unlock her LPT, which she can then return to the original AMM for her current share of the liquidity pool’s value and trading fees that the pool has earned.

Fig 1. How Unbound’s stablecoin is minted and loaned (source)

Notably, Alice is never at risk for having her LPT liquidated to other users, as Unbound doesn’t have a liquidation engine to other users (since synthetic assets are collateralized in LPTs, which are generally untradable compared to BTC, ETH, etc.), solving for one of the biggest risks and barriers to entry in the stablecoin ecosystem today. Even if the value of her LPT falls below some critical collateralization ratio, Alice is never required to pay the difference. Moreover, Alice takes on zero debt when borrowing UND from Unbound’s protocol –– there are absolutely no interest rates, she can redeem her collateral at the exact same price she deposited it at.

Unbound is able to offer these incredible loans thanks to three key characteristics of the protocol:

A variable loan-to-value (LTV) ratio, which regulates how much UND a user can mint given a particular amount of collateral. The largest risk towards undercollateralizing UND loans with LPTs comes from the impermanent loss problem, which essentially erodes the value of a user’s assets in a liquidity pool compared to if the user just held them directly. Unbound’s protocol uses an algorithm to predict the degree of impermanent loss that would undercollateralize their loans and then sets its LTV based on that prediction.

The relative stability of value for LPT tokens as collateral, as opposed to highly volatile assets like BTC and ETH

The SAFU fund –– Unbound’s insurance fund that grows with a portion (currently 40%) of the protocol’s minting fees, and helps maintain the dollar peg and prevent against black swan events

UND maintains its peg the US dollar through a variable minting fee (charged upfront that can also act as a stability fee) on Unbound, as well as via AMMs (primarily a UND-DAI liquidity pool) on the protocol where arbitrageurs correct the price of UND to match 1 USD during price fluctuations.

What’s next for Unbound?

Unbound already supports AMMs like Uniswap, Balancer, Sushiswap, and more –– meaning that the average DeFi LP with LPTs for the most popular Ethereum-based AMMs can get started on Unbound Finance immediately. They plan to expand their integrations to include more AMMs, like PancakeSwap and DFYN, as well as other blockchain ecosystems, like Binance Smart Chain (BSC), Polygon, and more.

Beyond expanding to other chains and dapps, Unbound plans to issue loans in other synthetic assets (e.g. uETH, a token that tracks the price of ETH), introduce a virtual AMM to autonomously supply liquidity, add on-chain price oracles to find accurate prices and minimize the risk of loss to users, and create a liquidation engine for highly-volatile pairs. Unbound is also building V3 liquidity aggregator contract that is already live on testnet. The protocol also plans to implement a DAO for decentralized governance using the native UNB token.

Final Thoughts

Unbound Finance is one of the most exciting projects of the crypto space today, because of its unbeatable commitment towards making DeFi truly decentralized. Its protocol enables liquidity providers to use the assets they’ve already locked up in liquidity pools, greatly expanding the scope of liquidity on Ethereum today. Their vision to compose DeFi-native derivatives across several blockchains and AMMs can also relieve the immense concentration of liquidity on flagship crypto products like Ethereum and Uniswap, unlocking new sources of capital for newer, more innovative crypto projects in the future. Ultimately, Unbound presents a promising model for the open flow of liquidity across a myriad of DeFi products, laying the path for the highly-composable, cross-chain DeFi of the future.

- Paul V

DIGESTS

DAOs have taken center stage.

Circle is soon releasing the easiest way for businesses to access DeFi, enabling companies to easily and confidently access new lending markets powered by decentralized finance.

NEWS

Despite falling prices, Salinas is incredibly bullish about the world’s biggest cryptocurrency.

REGULATIONS

Every adult citizen in El Salvador will receive $30 worth of bitcoin when they download and register the government’s cryptocurrency app

Coinbase CEO Brian Armstrong stated that the exchange’s goal is to list “every” crypto asset as long as it is legal.

IN THE TWEETS

👀 Meanwhile, the #1inch Limit Order Protocol quietly hit a milestone!

🔥 $10M in 24h trading volume 🔥

🔗 duneanalytics.com/k06a/1inch-Lim…

#DeFi#crypto#cryptotrading

— 1inch Network (@1inch)

2:18 PM • Jun 28, 2021

NEW PRODUCTS AND HOT DEALS

It’s the firm’s second $100 million raise this year.

With $2.5 million in seed funding, Coinvise is bringing social tokens to Ethereum and Polygon.

Blockchain analytics startup Nansen is building a product for crypto traders and hedge funds to more confidently navigate the world of decentralized finance. Their product analyzes public blockchain information across some 90 million Ethereum wallets to clue users into evolving opportunities.

LETS MEET UP

Paris, July 20-22, Ethereum Community Conference 4

New York City, July 26-28

Los Angeles, July 29-30

Coffee meetings or walks in San Francisco

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.